Lots of things caused the Great Recession we’re in, but the biggest was the subprime mortgage crisis. And what caused that? Government meddling in the housing market, that’s what. Guess we’ll never do that again, right? Wrong. We’re at it again and this time it’s worse.

The full faith and credit of the United States of America - which used to mean something - is getting behind mortgages for up to 150% of what a house is worth. Yes, you read that right. Our brilliant federal officials are guaranteeing mortgages to underwater homeowners for more than their houses are worth! It was bad enough that our government caused the housing bubble by strong-arming banks into writing mortgages to people who couldn’t pay them back. Now that housing prices have tumbled and foreclosures have gone through the roof, our government is propping up what’s left of the housing market by pushing 150% mortgages with all of us on the hook for them.

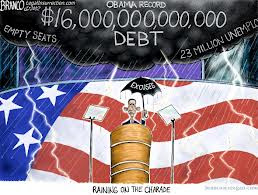

Oh and by the way: we’re more than $16 trillion in debt. That means we’re the absolutely biggest debtor nation in history and getting bigger by the hour. So what are those geniuses we elected to the White House and Congress doing about this? Furrowing their brows and pretending to do something while making it worse all the time. They keep borrowing, and now 70% of our new debt is “purchased” by the Federal Reserve. For you low-information voters who gave Dear Leader his second term, here’s a little economics lesson:

When the US Government borrows money, it issues bonds. Think of these bonds as IOUs the government gives to people it borrows from. Remember the US Savings Bonds your grandmother gave you for your birthday? Those pieces of paper didn’t represent the US saving anything. They represented the US borrowing from your grandmother and promising to pay back whatever number of dollars it printed on the bonds. They were IOUs with interest. Got that? Our government was going further into debt and Grammy believed it would pay her (or you) back.

Well, that belief about the US Government’s ability to pay back what it borrows has been shaken severely. The rest of the world is nervous about the financial stability of the US Government and you should be too - but clearly you aren’t, or you wouldn’t have voted for the Dear Leader.

When Treasury Secretary Tim Geithner issues bonds, (tries to borrow more trillions of dollars), buyers say “Uh-uh. No way am I going to lend you any more money. Not for that low interest rate.” However, the US Government isn’t about to let interest rates go up because that would hasten its bankruptcy.

So what does it do? It hints to Bald, Bearded Ben Bernanke - Chairman of the “independent” Federal Reserve - that it needs more “Quantitative Easing.” And what the heck is “Quantitative Easing” you may ask? It’s Bald Bearded Ben creating trillions of dollars out of thin air. He’s printing monopoly money. When he denies that the “independent” Federal Reserve prints money, he’s not telling the truth. Oh, technically he’s right. The dollars he’s creating out of thin air are not paper dollars or what we call “hard copy.” They’re digital dollars.

We all know people with huge credit card debt. How did they get there? Did they pass hard-copy dollars when they bought things? No. They used digital dollars. When they reached their debt ceiling, what did they do? They got another credit card and rolled their debt over onto it. Did any hard copy dollars change hands? No. They continued doing this as long as they were allowed to. Let me repeat that: As long as they were allowed to. This is what the US Government is doing through the Federal Reserve - rolling old debt into ever-increasing new debt. How long will they continue doing this? As long as they’re allowed to.

We all know people with huge credit card debt. How did they get there? Did they pass hard-copy dollars when they bought things? No. They used digital dollars. When they reached their debt ceiling, what did they do? They got another credit card and rolled their debt over onto it. Did any hard copy dollars change hands? No. They continued doing this as long as they were allowed to. Let me repeat that: As long as they were allowed to. This is what the US Government is doing through the Federal Reserve - rolling old debt into ever-increasing new debt. How long will they continue doing this? As long as they’re allowed to.

And who allows them? We do.

Now think what would happen if people with huge credit-card debt obtained printing presses that could print dollars - or super computers that could create digital dollars - without going to jail. What would happen to our economy with all that funny money in circulation? It would collapse, right? But that’s what Bald, Bearded Ben Bernanke is going at the Federal Reserve in his third round of printing/creating dollars - that he calls “Quantitative Easing.”

Low-information voters gave us the Ivy-League educated, government leaders who assure us that all this is okay because they know what they’re doing. Barack and Ben must know what they’re doing because they went to Harvard, right? They’re smarter than the rest of us and we’ve put our faith in them, so everything will be all right, won’t it?

Dream on.

The economic mess Dear Leader inherited from Bush is nothing compared to what he’s inheriting from his own first term.

The full faith and credit of the United States of America - which used to mean something - is getting behind mortgages for up to 150% of what a house is worth. Yes, you read that right. Our brilliant federal officials are guaranteeing mortgages to underwater homeowners for more than their houses are worth! It was bad enough that our government caused the housing bubble by strong-arming banks into writing mortgages to people who couldn’t pay them back. Now that housing prices have tumbled and foreclosures have gone through the roof, our government is propping up what’s left of the housing market by pushing 150% mortgages with all of us on the hook for them.

Oh and by the way: we’re more than $16 trillion in debt. That means we’re the absolutely biggest debtor nation in history and getting bigger by the hour. So what are those geniuses we elected to the White House and Congress doing about this? Furrowing their brows and pretending to do something while making it worse all the time. They keep borrowing, and now 70% of our new debt is “purchased” by the Federal Reserve. For you low-information voters who gave Dear Leader his second term, here’s a little economics lesson:

When the US Government borrows money, it issues bonds. Think of these bonds as IOUs the government gives to people it borrows from. Remember the US Savings Bonds your grandmother gave you for your birthday? Those pieces of paper didn’t represent the US saving anything. They represented the US borrowing from your grandmother and promising to pay back whatever number of dollars it printed on the bonds. They were IOUs with interest. Got that? Our government was going further into debt and Grammy believed it would pay her (or you) back.

Well, that belief about the US Government’s ability to pay back what it borrows has been shaken severely. The rest of the world is nervous about the financial stability of the US Government and you should be too - but clearly you aren’t, or you wouldn’t have voted for the Dear Leader.

When Treasury Secretary Tim Geithner issues bonds, (tries to borrow more trillions of dollars), buyers say “Uh-uh. No way am I going to lend you any more money. Not for that low interest rate.” However, the US Government isn’t about to let interest rates go up because that would hasten its bankruptcy.

So what does it do? It hints to Bald, Bearded Ben Bernanke - Chairman of the “independent” Federal Reserve - that it needs more “Quantitative Easing.” And what the heck is “Quantitative Easing” you may ask? It’s Bald Bearded Ben creating trillions of dollars out of thin air. He’s printing monopoly money. When he denies that the “independent” Federal Reserve prints money, he’s not telling the truth. Oh, technically he’s right. The dollars he’s creating out of thin air are not paper dollars or what we call “hard copy.” They’re digital dollars.

We all know people with huge credit card debt. How did they get there? Did they pass hard-copy dollars when they bought things? No. They used digital dollars. When they reached their debt ceiling, what did they do? They got another credit card and rolled their debt over onto it. Did any hard copy dollars change hands? No. They continued doing this as long as they were allowed to. Let me repeat that: As long as they were allowed to. This is what the US Government is doing through the Federal Reserve - rolling old debt into ever-increasing new debt. How long will they continue doing this? As long as they’re allowed to.

We all know people with huge credit card debt. How did they get there? Did they pass hard-copy dollars when they bought things? No. They used digital dollars. When they reached their debt ceiling, what did they do? They got another credit card and rolled their debt over onto it. Did any hard copy dollars change hands? No. They continued doing this as long as they were allowed to. Let me repeat that: As long as they were allowed to. This is what the US Government is doing through the Federal Reserve - rolling old debt into ever-increasing new debt. How long will they continue doing this? As long as they’re allowed to.And who allows them? We do.

Now think what would happen if people with huge credit-card debt obtained printing presses that could print dollars - or super computers that could create digital dollars - without going to jail. What would happen to our economy with all that funny money in circulation? It would collapse, right? But that’s what Bald, Bearded Ben Bernanke is going at the Federal Reserve in his third round of printing/creating dollars - that he calls “Quantitative Easing.”

Low-information voters gave us the Ivy-League educated, government leaders who assure us that all this is okay because they know what they’re doing. Barack and Ben must know what they’re doing because they went to Harvard, right? They’re smarter than the rest of us and we’ve put our faith in them, so everything will be all right, won’t it?

Dream on.

The economic mess Dear Leader inherited from Bush is nothing compared to what he’s inheriting from his own first term.

15 comments:

Right on and very frightening.

You sum up your column by saying that "The economic mess Dear Leader inherited from Bush is nothing compared to what he’s inheriting from his own first term." despite the fact that even Fox news admits that the economy is better now than when Obama took over 4 years ago.

http://www.foxnews.com/opinion/2012/02/28/thanks-to-stimulus-our-economy-is-better-off-than-it-was-4-years/

I know we shouldn't expect columns based on facts and reality, but this week was even dissapointing in the humor department. "Dear Leader"? Kinda lame. And third grade illiteration with Bernanke?

ok, I get it....the funny thing is that your jokes and insults are SOOOOO very lame! Still, you seem to be slacking.

But why would the government guarantee loans for MORE than the value of the property? Who ended up with the guaranteed loan $$$ when the collapse hit the fan? Brahahahaha....

Tom, could you lease give a link that better explains what you are referring to with the 150% mortgage thing? Are you talking about mortgages where the borrower owes more than the house is worth? Sorry, but I am unclear.

You got it right.

It's called "HARP 2" and mortgage loans are offered for no less than 120% of assessed value and not more than 150%.

Here's a link:

http://activerain.com/blogsview/3411509/harp-2-0-saving-arizona-families-and-their-homes

Fred, you made it to the end of the column before calling BS? I didn't make it past the third sentence when Tom lets bankers off the hook and blames government to the mortgage crisis.

What happened to conservative accountability, "the buck stops here", and all that? Tom is really going to claim that bankers were not involved in a greedy pyramid scheme, but were somehow "forced" to give out bad loans?

Let me preempt Tom here in case he tries to point to the Obama/Citibank lawsuit. This was disproved by Snopes as a reason for banks giving bad loans.

record, and no doubt will echo throughout the right-wing propaganda machine at least through November.

http://www.snopes.com/politics/obama/loans.asp

Claim: Barack Obama filed a lawsuit to require banks to “make loans to poor people.”

Status: False.

The 1994 case of Buycks-Roberson v. Citibank Fed. Sav. Bank had nothing to do with requiring lenders to do business with people "who could not show proof that they could pay the money back." The case was a class-action lawsuit against Citibank Federal Savings on behalf of a black Chicago woman, Selma Buycks-Roberson, who claimed she was unfairly denied a mortgage based on her race. The lawsuit sought to end the practice of redlining, a discriminatory practice by which banks, insurance companies, and other business institutions refuse or limit loans, mortgages, insurance, etc., based solely on the geographic area in which the applicant lives (a practice that commonly excludes minorities in inner-city neighborhoods, regardless of their income or ability to pay). Specifically, the lawsuit charged that Citibank "rejected loan applications of minority applicants while approving loan applications filed by white applicants with similar financial characteristics and credit histories."

So just how were the poor, unfairly picked on bankers forced to give these loans, Tom?

I don't quite see the problem of a program like Harp 2 that helps out only if you have been responsible in paying your mortgage and not fallen behind on your payments, but have been unable to get traditional refinancing because the value of your home has declined.

You don't see the problem, Judy? The problem is that the program HELPS people. Conservatives don't like that. Oh, unless the fire department is putting out a fire in their house or something else that helps THEM.

The Community Reinvestment Act established in the seventies and expanded under Clinton did indeed force banks to lend to people who didn't meet credit standards normally applied.

ACORN pressured banks to grand loans to people who had no money to put down and for whom welfare payments qualified as income. Even illegal aliens got mortgages.

Thomas Sowell's book pictured above documents the whole thing.

Judy: HARP 2 is part of the Dodd-Frank bill. Fannie Mae will back mortgages of up to 150% of the home's value.

What if people walk away from those mortgages? Taxpayers are on the hook once again, just as they were during the first crisis.

Government has to get out of the housing business. Let foreclosures occur and let the market determine what a house is worth. If people took too much risk and bought just before the decline in prices, they'll just have to suck it up and go rent. Then try to buy again when prices bottom out.

Any investment is a risk. If Anonymous wants to help, let him, but I doubt he would with his own money. He'd be glad to give away someone else's money though.

Leave my money alone. I saved up for my first house and bought one I could afford to fix up. Then I made my payments and I own it. It's value has gone down along with all housing, but I'm not whining about it.

Oh, so it is some Act that was passed 40 years ago that made modern bankers give out bad loans?

And ACORN "pressured" them....how so? What exactly did they say would happen to these banks if they did not follow through? Break their knee-caps? It is called personal responsibility. Don't pass the buck.

Just let foreclosures occur? Just let greedy bankers pull their schemes on naive clients? OK, I guess you could argue that the clients should know better, but I think a stronger arguement is that we should live under a system where we can trust our bankers, because if they pull a fast one on us then they will pay severe consequences, and not be excused by people like you who say it is not their fault but the governments.

You're not whining about your home value? Seems that is one of the only things you are NOT whining about then.

Gregg:

You write: "And ACORN pressured' them....how so? What exactly did they say would happen to these banks if they did not follow through?"

Again, Sowell's book spells it out in much more detail, but the following Stanley Kurtz article is a short read and will answer your question.

http://www.nationalreview.com/articles/225898/planting-seeds-disaster/stanley-kurtz

Tom, do you really believe that some little non-profit strong-armed some of the biggest, richest, most-powerful organizations in the world? C'mon.

Step outside your bubble. Don't just look at sites that you know are going to agree with you. Check out the facts that other sides present.

Factcheck.org says "It stretches the facts to say that ACORN "forced" banks to make risky loans"

Yes, after studies showed that high-income minorities were more likely to be turned down than low-income whites, ACORN then started a mortgage assistance program to help minority and low-income borrowers get mortgage loans, but insisting the organization is to blame for the mortgage crisis because it helped low-income Americans receive home loans by way of the Community Reinvestment Act (CRA), that is just not the case.

From Media Matters:

"In The Current Mortgage Meltdown, Did Lenders Approve Bad Loans To Comply With CRA, Or To Make Money?"

The evidence strongly suggests the latter. First of all, the program is over 35 years old and no problems occured until recently. Second, it is hard to blame CRA for the mortgage meltdown when CRA doesn't even apply to most of the loans that are behind it. About 1 out of 4 sub-prime loans were under CRA regulations. Who is your scapegoat for the other 75%? Surely not those nice, innocent bankers.

Now get this:

Most important, the lenders subject to CRA have engaged in LESS, not more, of the most dangerous lending. Janet Yellen, president of the San Francisco Federal Reserve, offers the killer statistic: Independent mortgage companies, which are not covered by CRA, made high-priced loans at more than twice the rate of the banks and thrifts.

Sorry Tom, your right wing attempt at creating a scapegoat is blown out of the water.

Michael Lewis has written brilliantly on this subject. His book, “The Big Short” follows the stories of a handful of guys who anticipated, the now absurd notion that the housing market wouldn’t rise forever and they bet against it. In a 2011 bloomberg.com article, he pulled this quote from the 2011 Financial Crisis Inquiry Commission’s report: “Frankly, the commission’s report does nothing to improve public morals. In discussing the role of the 1977 Community Reinvestment Act, for instance, the report notes that the loans made by big banks to meet the act’s requirements -- that is, loans to poor people in crap neighborhoods -- outperformed, dramatically, the general run of subprime loans.”

I don’t doubt for a minute that government engineering contributed to the environment that precipitated the crash, and investor irresponsibility was also a factor. But the government didn’t create those arcane, highly risky financial instruments: mortgage-back securities, credit default swaps, collateralized debt obligations, etc. By 2005, $507 billion worth of subprime mortgages were written, packaged into bonds and sold to investors as AAA rated investments: mortgage-backed securities (MBS). Mortgage lenders wrote mortgages for well-researched, prime borrowers and then sold the mortgages to banks. Banks, in turn, bundled the mortgages into bonds and sold them off. Everyone made money, until the pool prime borrowers began drying up. Lenders then went after subprime borrowers and the process continued, albeit with far riskier mortgages but still promoted as stable investments.

Moodys, Standard and Poors and other rating agencies, who are paid by the banks – Bank of America, Bear Stearns, Leahman Brothers, Wachovia, Washington Mutual, Chase, JP Morgan, Morgan Stanley, Citicorp, etc – rate the banks’ investments. If a bank doesn’t get the rating they want, they take their business elsewhere. One way the rating agencies manipulated the investment ratings they generated, was to fudge the FICO scores in a MBS. A MBS comprised thousands of individual mortgages, some good, many not so good. Instead of publishing a FICO score for every mortgage holder in every bond sold, they calculated the average FICO score for an entire bond. If the average FICO score for a MBS was 675, for example, that would seem like a relatively sound investment. But that average score hid the fact that many of the mortgages in that bond, or any bond, were south of 600. A mortgage holder with a 550 FICO score was far more likely to default than a mortgage holder with a 725 FICO score. By rating a bond AAA and omitting the credit history of all the subprime mortgage holders in a given bond from the rating report, the investor was purposely deceived.

Capitalism is the best system there is, at least I’m not interested in exploring any of the known alternatives, but the catch-22 of capitalism is that money is the most corrupting force on earth. And that’s a damn fact.

Hmm. Can't disagree with anything you wrote here. What's going on?

Yes. All those financial instruments were created with very troubled assets and many made billions from them. They all contributed to the big collapse.

So then came TARP - Troubled Assets Relief Program - government bailouts from government/corporate shenanigans, and none of it a good idea. I'd have voted against it if I could.

But then the whole thing might have crumbled, some claim. Yes, maybe it would have, but eventually we would all pick up the pieces and say to ourselves, "Wow! Guess we won't try that again."

But sadly, we continue trying to engineer it in the Keynesian way, which hasn't worked anywhere it has been used.

What about all those who lost money and will continue to lose money? I say Caveat Emptor. Let the buyer beware. A fool and his money are soon parted. Government can't fix everything. When it tries, it makes things worse. Now government and its (our) money have parted. China has $1.2 trillion of our debt and they're communists. Talk about irony.

Thanks for your post. I’ve been thinking about writing a very comparable post over the last couple of weeks, I’ll probably keep it short and sweet and link to this instead if thats cool. Thanks. hard money loans pompano beach

Post a Comment